💡Lessons Learned:

As an average investor, the goal should be achieving a consistent and average return for long term investment.

In personal finance discussions, you often see these common questions:

“Is my retirement planning on track?”

“Am I on track to be FIRE?”

“How can we improve our financial strategy?”

Building wealth depends on long term investment

In short, people want to know if their money is placed in the right investments to provide the best returns.

Additional reading: You can find my part 1 discussion ‘Should I Save or Invest?’

My Story:

When I began investing, I tried various pieces of advice from podcasts, internet articles, YouTube, etc. I made numerous mistakes and lost valuable time making money work for me. 😣

Fancy financial products do not always provide good return

- Target date funds

- Robo-advisors, based on your investment type.

- Picking specific stocks

- Investing in index funds

| Year | Products | Return |

|---|---|---|

| 2014 – 2018 | Picked funds focused on specific industries | 🔻 |

| 2019 – 2021 | Used robo advisors and target date funds | 😐 |

| 2022 – now | Focused on index funds | 😀 |

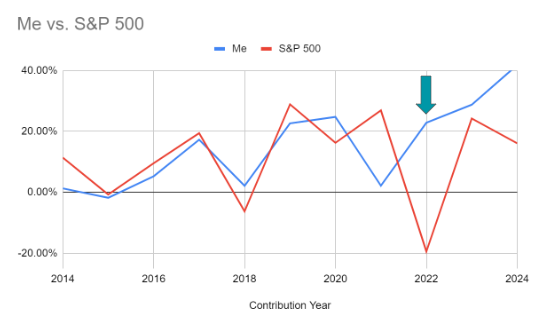

My investment returns showed more consistent growth after I focused on index fund investments (see arrow).

This Strategy Works for Me Because

- I am a passive investor. I don’t like to do extensive homework for active trading, but I did my homework to understand different financial products before investing.

- I value long term investment over short-term gains.

- I look for consistent growth rather than explosive growth in a short period.

- I hold investments to leverage the power of compounding interest.

- I value diversification and avoid putting all my eggs in one basket (e.g. individual stocks or industries).