You already make regular savings, but are you unsure if you’re putting your money in the right place? Are you wondering if you’re on track for your retirement goals or if you’ve picked the right investments?

Highlights:

- Focus on the long term. Let money work for you effectively and produce more value within acceptable risks.

- Understanding how investments work is better than fearing them and avoiding them altogether. Knowing the pros and cons of investing helps overcome fear.

Save or Invest?

We all know we should let money work for us. But what does that mean exactly?

My Story:

I initially put a large chunk of money in savings accounts. Mentally, I felt very safe because I could access my money right away. I was satisfied with the little interest the banks paid me each year.

At the same time, I knew nothing but bad things about investing. When I made my first investment, I lost 10% of it within the first few months. This loss made me feel terrible, and I ignored that account for many years.

Fast forward, I was forced to face reality when I had my first workplace retirement account. Over the years, I realized I should focus on long-term value, not short-term fluctuations.

Asset Allocation: Optimizing Growth by Allocating Funds

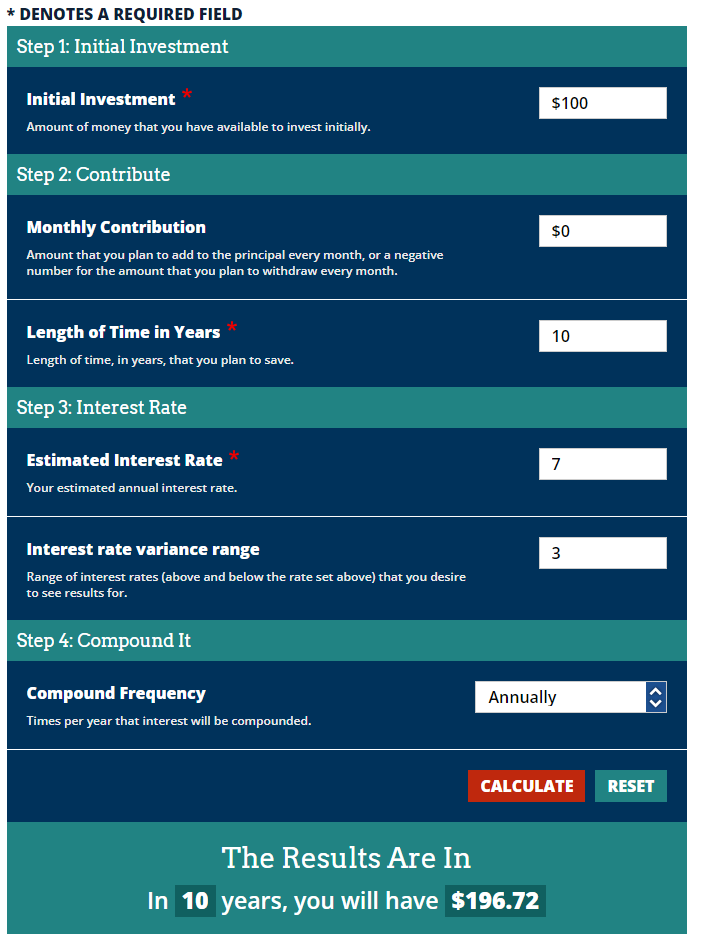

Earning $96 vs. $5, which one do you want?

| Money I put in now | Money I earned 10 years from now | |

|---|---|---|

| Investment with Index funds | $100 | $196.72 |

| Savings account | $100 | $105.11 |

Tool: Compound Interest Calculator | Investor.gov

Note: Of course, you need to pick a fund that will consistently grow, which is another story.